When The Fed Raises Interest Rates, Where Will We Feel It?

Economists, policymakers & political observers have grown increasingly concerned about the far-reaching consequences of rising inflation .... but, they're just as worried about Fed's response to it

Aspen Aldama | Learn4Life CLMI Fellow

Spiking Inflation rates are rippling through the economy. Everyone is feeling it. Economists, policy thinkers and political observers alike have grown increasingly concerned about the far-reaching consequences of those spikes on everyday Americans who are grappling to survive the insufferable consequences of loose monetary policies. "It’s going to get worse before it gets better, and unfortunately, we’re just compounding the harms of the challenges that we’ve already been experiencing with the pandemic," business law professor Dietrich Von Biedenfeld said in recent interview regarding the trajectory of inflation. Sadly, global and national trends statistics are only proving this assessment to be correct.

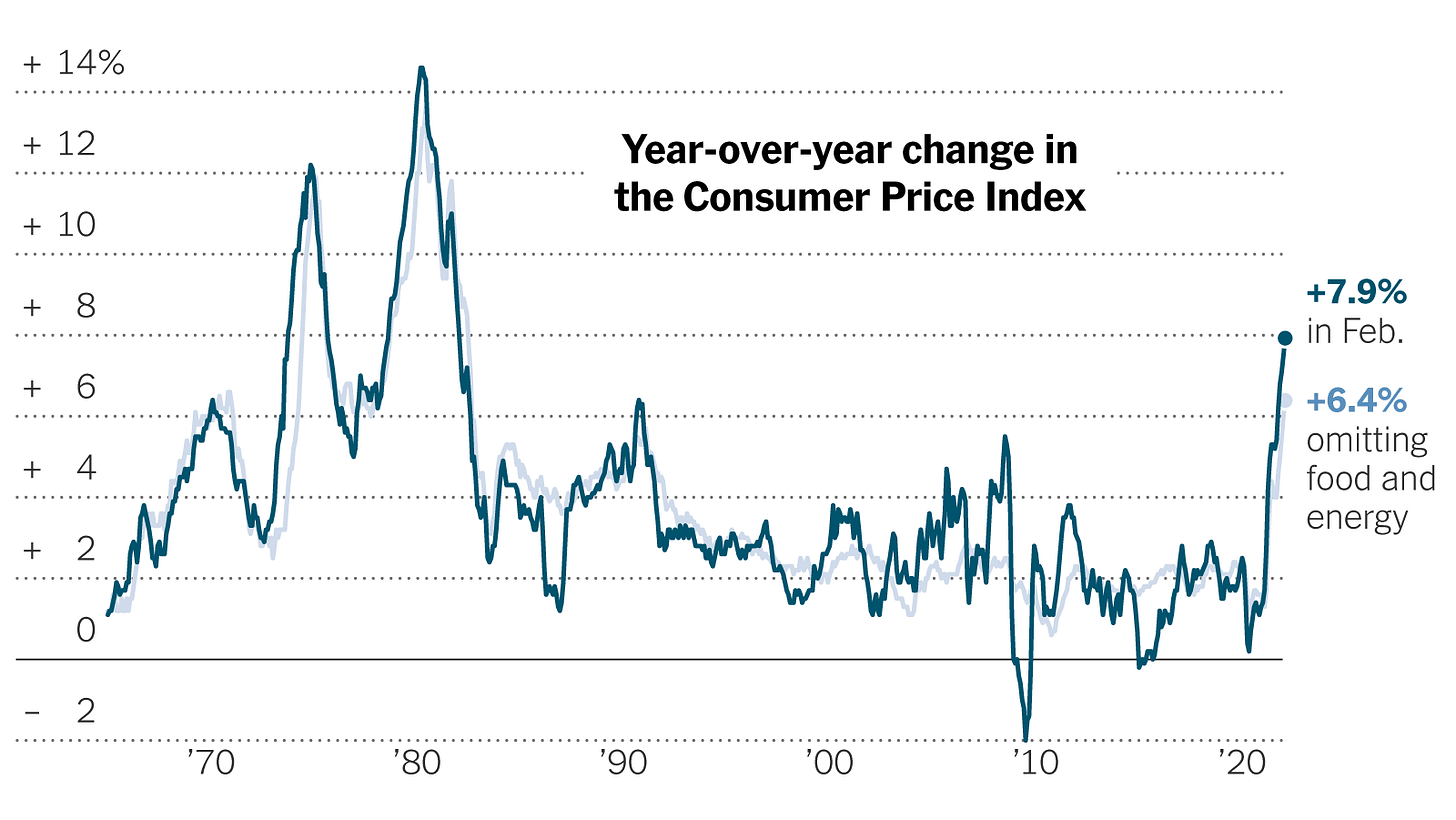

In the past 12 months alone, inflation has climbed to a record 40-year high of close to 8 percent (February 2022). This is in comparison to last year, which was only under 2 percent (February 2021). In some sectors of the economy, inflation is double digits, as illustrated in this New York Times interactive graph …

The effects, unsurprisingly, result in Americans being subjected to higher prices for a variety of goods and services. For instance, the cost of groceries has gone up 8 percent …

… housing costs have risen by nearly 5 percent …

… And gas prices have soared to a staggering 38 percent.

As reported by AAA Gas Prices, the national average of gas prices is at $4.24, which was only $2.87 this time last year. According to survey data collected by the University of Michigan, consumer sentiment for the month of March has fallen to its lowest level since 2011 in accordance with gas prices. Analysts from Goldman Sachs predict that the crisis will only worse as the war between Ukraine and Russia rages on, with sanctions against Russia straining global energy and gas markets while destruction in Ukraine also strains wheat and grain supplies.

To counteract inflation, the Federal Reserve motioned plans earlier in the month to raise interest rates by a quarter of a point seven times throughout the remainder of the year and four times in 2023. Effectually, monetary policies such as raising the benchmark federal funds rate are supposed to disincentivize spending for both consumers and businesses by raising borrowing costs and interest on debt, thus lowering consumer demand. When this happens, an overheating economy cools, and subsets of inflation abate.

As Fed Chairman Jerome H. Powell noted recently ….

Raising interest rates has a cooling effect on the economy, because it increases the costs associated with a wide range of lending, from mortgages and auto loans to business investments.

Luckily - from an economic standpoint - mortgage rates do not move in tandem with interest rate fluctuations. Long-term mortgage rates are typically determined by the 10-year Treasury note. However, outstanding debt does, as prime rates do fluctuate in coordination with these hikes, meaning interest will rise accordingly.

Though interest rate hikes can raise rates on debts and loans, the upside is that they can benefit the typical savings account. As put by nerdwallet.com …

Higher interest rates can raise costs for borrowers, but it can also mean higher yields for savers. After all, when you have a savings account at a bank, you’re effectively letting the bank borrow your money, and the institution pays you interest in return.

Besides raising interest rates, talks of reducing the Federal Reserve’s $8.9 trillion balance sheet have also been discussed, with Powell iterating in a recent press conference that “…. [The balance sheet] could come as soon as our next meeting in May, though that is not a decision that we have made.”

However, many Americans are concerned with the Federal Reserve's current handling of inflation and are worried about how effective their deterrents will be, especially with their recent attempts of negating inflation by labeling it transitory. Many are worried that the interest rate hikes are too little, too late.

Here was Henry Curr’s take, economics editor for The Economist, during an interview with Hutchins Center …

Yes [the Feds are behind the curve]. What the Fed said last year was, in effect, we’re not that worried about inflation because inflation expectations are anchored, so we, therefore, think inflation will be transitory. When I was taught economics, I was taught that the reason you have independent central banks is to avoid a situation where short-sighted politicians …. Push as hard as they can on the employment side of their mandates …. It’s not all clear to me how pushing as hard as you can on employment while pointing to inflation expectations being anchored as the justification is all that different from the inflation-bias scenario that the textbooks warn about.

Curr isn’t the only one concerned about the Federal Reserve's attempts. Larry Summers, former treasury secretary under Bill Clinton, noted that …

I believe the Fed has not internalized the magnitude of its errors over the past year, is operating with an inappropriate and dangerous framework and needs to take far stronger action to support price stability than appears likely.

According to a survey conducted by the National Association for Business Economics (NABE) on its member economists, 77 percent believe the Fed's interest rate hikes remain too low, and nearly the same proportion expressed their concerns that inflation would remain above 3 percent coming into 2023.

Clearly hearing concerns from economists about monetary policies not being harsh enough, Powell assured the public that he would enact more strident measures if needed. That might include raising interest rates by a half-point instead of a quarter-point. Even after professing he would take more hawkish measures, however, many are still worried that the Federal Reserve under Powell doesn’t have a firm handle on the situation. Only time, as well as an unpredictable mix of geopolitical events, will tell.