Villegas | CLMI

In its most basic form, Social Security is best known as a critical federal program that many people cannot do without: with nearly 12 percent of the U.S. population living below the poverty threshold and nearly 30 percent living as lower income, Social Security offers a layer of financial protection to Americans in retirement, individuals with disabilities, and military veterans. The system, with multiple changes throughout since it’s creation in 1935, ensures these demographic groups have the support needed to maintain something close to a decent or quality standard of living while meeting essential needs as they navigate various life challenges. Contrary to the more pervasive views and perspectives on Social Security, a significant portion of beneficiaries are disabled workers and independents, as the Center for Budget and Policy Priorities shows …

The CBPP further notes that …

While older adults make up about 4 in 5 beneficiaries, the other one-fifth of beneficiaries received Social Security Disability Insurance (SSDI) or were young survivors of deceased workers. In addition to Social Security’s retirement benefits, workers earn life insurance and SSDI protection by making Social Security payroll tax contributions …

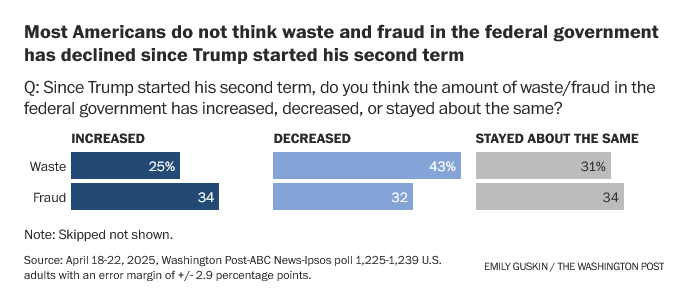

However, Trump administration adviser and Department of Government Efficiency head Elon Musk recently called the system a “Ponzi scheme,” claiming that it generated $500 billion to $700 billion in waste. According to Musk “… 20 million people … are definitely dead marked as alive in the Social Security database” out of the 73 million Americans currently receiving it - that’s a stunning claim, estimating 28 percent of Social Security benefits are fraudulent. Yet, there is no data to support Musk’s arguments. When fact checked by media and the Social Security administration’s own Inspector General, just $72 billion in “improper payments” were discovered over eight fiscal years between 2015 - 2022. That’s less than 1 percent of the total disbursed, as Social Security pays out more than $1.3 trillion dollars each fiscal year.

Proposing significant cuts to Social Security has, predictably, raised quite a few brows and questions. But more alarming for many is the dramatic cuts to Social Security already taking place, including 12 percent of its workforce, which has caused headaches for recipients. In addition, Trump has even suggested getting rid of 7,500 federal government leases, which could further complicate the situation. As NPR reports …

Rich Couture, a spokesman for AFGE SSA's General Committee, says more than 2,500 employees at the agency have taken an offered buyout, and that many of the workers who have left were in critical roles — including those local field offices.

"That's the primary point of contact, other than the 1-800 number, that the American people have with Social Security," he said. "They take care of enumeration issues with respect to Social Security cards, handle retirement, disability survivor claims, interviews and processing, among other workloads."

Couture says the agency has lost about 2,000 employees specifically from the field offices through the federal government's buyout program.

These losses have disproportionately affected certain local offices. Couture told NPR that there are about 40 field offices that have lost at least 25% of their staff so far, and others, such as offices in Nevada, Mo., and Alexandria, Minn., have lost half or more of their workers, according to agency data.

Of course, lawmakers on both sides of the aisle are concerned - depending on who’s worrying and for what specific reason. Republican lawmakers are facing public backlash at town halls filled with angry constituents complaining about Trump administration plans and Musk meddling that wrecks their Social Security payments. Democratic lawmakers on the other hand are forced to answer tough questions in their districts, but resort to placing blame on an administration cutting the agency’s workforce and mission since they have no political clout in Washington. As a result, they find an opening for a political opportunity throughout upcoming elections, especially in 2026, as the New York Times reported …

Elon Musk, the multibillionaire overseeing the Trump administration effort to drastically shrink government, has derided the nation’s most popular federal program as a sketchy pyramid scheme while pushing to close offices and eliminate thousands of jobs of those who administer the program. In doing so, he has touched a topic that has traditionally been known as the third rail of American politics. And Democrats, who increasingly regard Mr. Musk as a more opportune political target than even President Trump himself, have rushed to highlight what they consider to be a major political blunder.

“They don’t learn,” Senator Chuck Schumer of New York, the Democratic leader, said of Republicans as his party pounced on the issue. “Their biggest mistake was going after Social Security when George Bush was president. And now they are doing it again.”

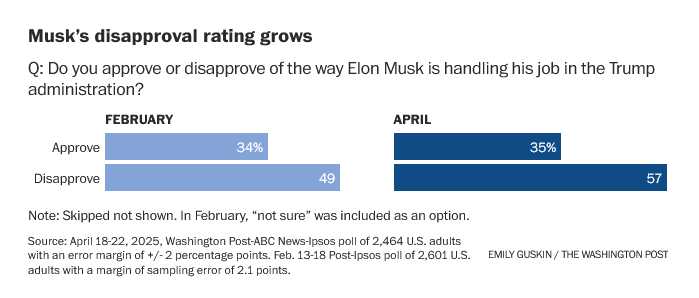

The level of frustration and anxiousness is unprecedented as both recipients and voters worry about the future of the entitlement program. Many within Musk’s own party and the administration believe the Tesla and Space X founder should stop discussing these potential changes, as they are concerned about the impact it could have on their benefits. Musk’s bold pronouncements about ending Social Security are leaving quite a mark on the political landscape. Public opinion polls are illuminating that shift …

Musk continues to present several reasons for wanting to cut Social Security. He often emphasizes that immigration plays a significant role, claiming that undocumented immigrants are fraudulently taking advantage of entitlement programs like Social Security, Medicaid, and disability benefits. He also suggests the benefits are part of a scheme by Democrats to gain votes.

However, it can be confusing to sort out the actual facts about Social Security fraud. There are the occasional news reports of fraud or waste or abuse, or cases where deceased persons haven’t had their deaths reported properly. This could lead to families incorrectly collecting benefits they aren’t entitled to. Yet, fraud claims by the administration are considered misleading, as a Brookings Institution study argues …

Axios reporter Emily Peck noted that during a press conference on March 18, acting Social Security Commissioner Lee Dudek stated that $100 million is lost annually to direct deposit fraud. The article further highlighted that the $100 million in fraud accounts for approximately 0.00625% of the $1.6 trillion the government distributes annually in Social Security benefits. Social Security is scrutinized regularly. In fact, congressional hearings last year focused on whether the agency was too aggressive in reclaiming funds after accidental overpayments.

Overall, the conversation about Social Security is complex and involves many factors, but Musk's claims raise questions about where the real problems lie and whether cutting benefits is the right solution for everyone involved. Understanding the full scope of the issue is crucial as it affects many people’s lives. It’s not the largest chunk of U.S. public debt, but it does, according to the Pew Center, account for the largest portion of what’s called “intragovernmental holdings.”

President Trump has said he is well aware of the importance of Social Security, especially since he promised last December after winning the election that he wouldn’t touch it. He knows that making cuts to this program would be political suicide and that diong so is viewed as widely unpopular, especially since it ranks in the top 5 issues Americans are worried about the most …

There are legitimate concerns about potential fraud across the entire government that occur each year, with the Government Accountability Office estimating system-wide discrepancies ranging between $233 billion and $521 billion every year. But, the Social Security Administration’s Inspector General found only $300 million in “payments after death over about two decades — about one-third of it recovered” - which is just 0.02 percent of the Social Security Administration’s massive $1.5 trillion dollar budget. Although federal officials have long recognized improper spending as a problem for SSA, it’s not the key problem troubling the agency: it’s an aging population as Market Watch points out …

But even they admit that Social Security is in trouble. Here’s why: Because for several years now, more money is being paid out to beneficiaries than is being taken in through payroll taxes. That means Social Security’s vaunted Trust Fund could run dry by 2033 — just eight years from now.

What happens then? Benefits would have to be cut to match what’s coming in through taxes. That cut is currently projected to be a painful 21%. This ominous forecast has been issued by the Social Security Administration itself for years, by both Republican- and Democratic- appointed officials.

This raises the question of how to address these issues without harming those who desperately need the assistance.

Many people rely on Social Security for their retirement, disability benefits, or support for their loved ones. The program is a vital safety net for millions of Americans. It’s crucial for leaders to find ways to, of course, improve the system so that the benefits can continue for those who need them the most. Instead of cutting this essential program, advocates argue that the focus should be on solutions that ensure its sustainability and effectiveness. Finding a balance between protecting these benefits while tackling fraud is essential for the well-being of many families across the country.

No cuts have been made just yet, but there are some major concerns about potential cuts to important programs like Medicaid, Medicare, and SNAP, which is the program helping low-income and impoverished individuals and families afford food, often referred to as food stamps. It seems the administration, for now, is still focused on fraud within SSA (which is just a small fraction of the overall Social Security budget) but their actions might lead to some negative consequences no one is prepared for.

Still, the Social Security Administration has announced they will start paying retroactive benefits, which means that some people will receive back payments for the money they should have received earlier. Additionally, there is a plan to increase monthly benefit payments. But it won’t erase growing public anxiety over looming cuts impacting nearly a quarter of the U.S. population.

DIAMOND VILLEGAS is a Fellow at the Civic Literacy & Media Influence Institute at Learn4Life