Debt Ceiling: Does the Economy Collapse ... or Just Continue to Inflate?

Most Americans don't know what the "debt ceiling" fight is all about or who to blame, really. As the June 1 deadline fast approaches, it will be important to understand debt clearly.

Brianna Gonzalez-Sanchez | a Learn4Life CLMI fellow

Last minute wrangling over debt ceiling doom by June 1st brings up uncomfortable talk about debt. You either hate it or you can manage to love it, depending on how you view it. Politically, Democrats and Republicans are attempting to find their point of leverage over the other in a game of economic Russian roulette. If the debt ceiling is finally breached, the incessant finger pointing will begin. Who will voters most likely blame?

Recent polls suggest it could be either, according to a Washington Post poll …

Because debt, especially in the context of this political fight, is still something most Americans don’t understand. Obviously, the debt ceiling not getting raised would be catastrophic. Yet, here we see a majority of those polled a recent Economist/YouGov survey thinking it’s a major problem, but not a crisis, which is worrisome. Maybe pollsters need to ask do voters understand what a “debt ceiling” is in the first place …

So, there are two types of debt when we have time to mull on it: 1) There’s personal debt. Without an adequate level of financial literacy, debt can be a tormenting matter that can drag you down financially, mentally, and emotionally. On the other hand, if you are financially literate, you can manage to use debt by leveraging it or, perhaps, supporting the establishment of a business, and to build a new stream of income.

That’s completely different from 2) collective economic debt. It highlights how we, as humans, cope with scarcity and how we leverage the institutions that evolve to coexist with us. Like the mass enslavement of African labor and the growth of fossil fuel-powered machinery that defined the 80 years of the Industrial Revolution (1760-1840) a revolution in which humanity transitioned from hand made goods to the expansion of machine-made goods. Our modern-day revolution is defined by 73-year evolution of technology (1950-2023), the creation of digital assets and currencies, and the curation of Artificial Intelligence (AI). Civilization, society, and the economy are among the most important constants of the world that change while simultaneously interconnecting with each other. As resources fluctuate in availability, value, demand, and supply, civilization adapts and gives value to what is inaugurated as new-currency. Modern day examples of a newer currency would be digital coin such as Bitcoin, XRP, Coinbase, etc. Money is evolving and so is the way one can make an income.

Which also takes us back to the collective debt: or the outstanding sum of debt owed by the federal government. As Congress and the White House battle over a fast-approaching debt ceiling deadline, we’re now pressed to understand more about the government’s overall financial obligation to pay public and private governmental departments. The debt accrued during that time includes spending on tax cuts, stimulus programs, increased government spending, and decreased tax revenue as a result of large unemployment rates.

How Did We Get So Much Debt?

The United States, of course, fell into debt way back to the time of its inception at the American Revolutionary War (1775-1783) against Britain, a cost of over $75 million dollars by 1791. It exploded 188 percent between the beginning of The Great Depression - which precipitated excessive, yet essential levels of government spending - and the beginning of America’s entrance into World War II in 1941.

Over these two centuries the economy has fluctuated drastically. There was a period of “Cold War” which added to the U.S.’s national debt as a consequence of funding large military costs, from the Korean War to the Vietnam War to a prolonged period of U.S. and Soviet military build up. This period of cold war occurred from 1945-1991 and does not account for current and ongoing military affairs. We also need to remember the largest tax cuts happening under President Reagan during the 1980s as military spending was rising. The tax cuts significantly slashed revenues even as there was a demand for a greater U.S. geopolitical footprint against communism.

But there is that majority of national debt held by the public, including individuals, companies, and foreign governments. The remaining debt is the inner government’s debt which involves all the government agencies and spending. The national debt also includes the accumulation of federal budget deficits. The largest deficit was occurred during President Obama’s dramatic response to the Great Recession, a deficit of $8 trillion triggered by spending he needed to resolve a disastrous financial crisis that nearly spiraled into a depression. President Trump, however, comes in second place for the second largest deficit of $7 trillion dollars, with debt accrued as a result of COVID-19 stimulus payments and also massive tax cuts of nearly $2 trillion.

A recent Center for American Progress analysis blames tax cuts for where we are now …

Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues. In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more. If not for the Bush tax cuts and their extensions — as well as the Trump tax cuts — revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining. Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57 percent of the increase in the debt ratio since 2001, and more than 90 percent of the increase in the debt ratio if the one-time costs of bills responding to COVID-19 and the Great Recession are excluded. Eventually, the tax cuts are projected to grow to more than 100 percent of the increase.

Our current president, Joe Biden has added a little over $2 trillion to the U.S. National Debt so far.

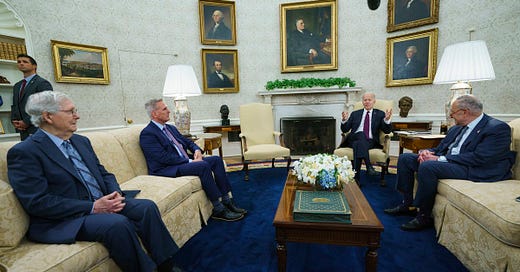

The President, a Democrat, wants to raise the debt ceiling immediately and House leaders, Republicans, must agree to raise the ceiling. The president has to somehow reconcile the reality of growing debt with spending, since the spending is far exceeding the revenues, while House Republicans need to reconcile the need for tax cuts that keep clawing into revenue. If the government continues to raise the debt ceiling, this means the U.S. is continually in a position where it’s always increasing the country’s debt in order to pay its bills. Other major Organization for Economic Cooperation and Development (OECD) countries aren’t faced with this problem as much, as the United States, according to the Center for American Progress …

[Still] ranks 32nd out of 38 in revenue as a percentage of GDP.20 But it’s not just that the United States is near the bottom end of revenue; it is nowhere close even to the average. Over the CBO’s 10-year budget window, the United States will collect $26 trillion less in revenues than it would if its revenue as a percentage of GDP were as high as the average OECD nation. When compared to EU nations, that number rises to $36 trillion.

Raising the debt ceiling is not so much related to future spending, it is an increased adjustment to the debt ceiling limit, which is the amount of funds the government may borrow in order to pay existing legal obligations such as military funding, government department pay, and government supplemental income. One possibility to lower the nation’s debt would be to create sustained and long-term policies that would ensure debt grows a slower rate than Gross Domestic Product (GDP). GDP is the essential formula which measures the monetary value of goods and services bought by a customer or consumer. Addressing the deterioration of the economy would not happen overnight. This would take at least a few decades to correct.

Raising the debt ceiling would not increase inflation but it would increase interest rates for debt payment. Inflation is a pull in demand of goods and services and an ultimate rise in the price of everything, with economists point to an imbalance of supply and demand. What contributes to inflation is the increased costs of policies, wages, and the devaluation of the U.S. Dollar. Addressing the debt crisis is an urgent matter that requires critical decision making that takes our entire economy and collective into consideration. Economic recovery will require immediate action before the duration of the crisis becomes catastrophic. Reform of policy - and the politicians, too - is needed to stop it and put us on a sustainable path.